Compute Weighted Average Cost of Capital in Cogynt

WACC, or weighted average cost of capital, is an important formula used in stock valuation. Without it, precision equity analysis of discount cash flow is challenging.

It is possible to use an arbitrary "discounted rate" when calculating discounted cash flow (DCF), but this rate is not as accurate as WACC.

The WACC is the average cost of generating the capital necessary to perform operations. In simple terms, such a figure might represent a 15% interest business loan. In more complex circumstances, WACC can include other forms of company debts (such as IPOs, other kinds of loans, and acquisitions).

Because WACC tells us the cost to generate capital, it is an important component of the DCF formula.

The formula for WACC looks like this:

WACC = (E/V * Ke) + (D/V) * Kd * (1 – Tax rate)

The formula works as follows:

- Start with your equity divided by the total equity plus debt.

- Multiply that figure by the cost of equity.

- Divide debt by equity plus debt. Multiply that value by the cost of debt, and then add the cost of equity and cost of debt figures together.

The final figure is the stock's WACC value.

Computing WACC in Cogynt

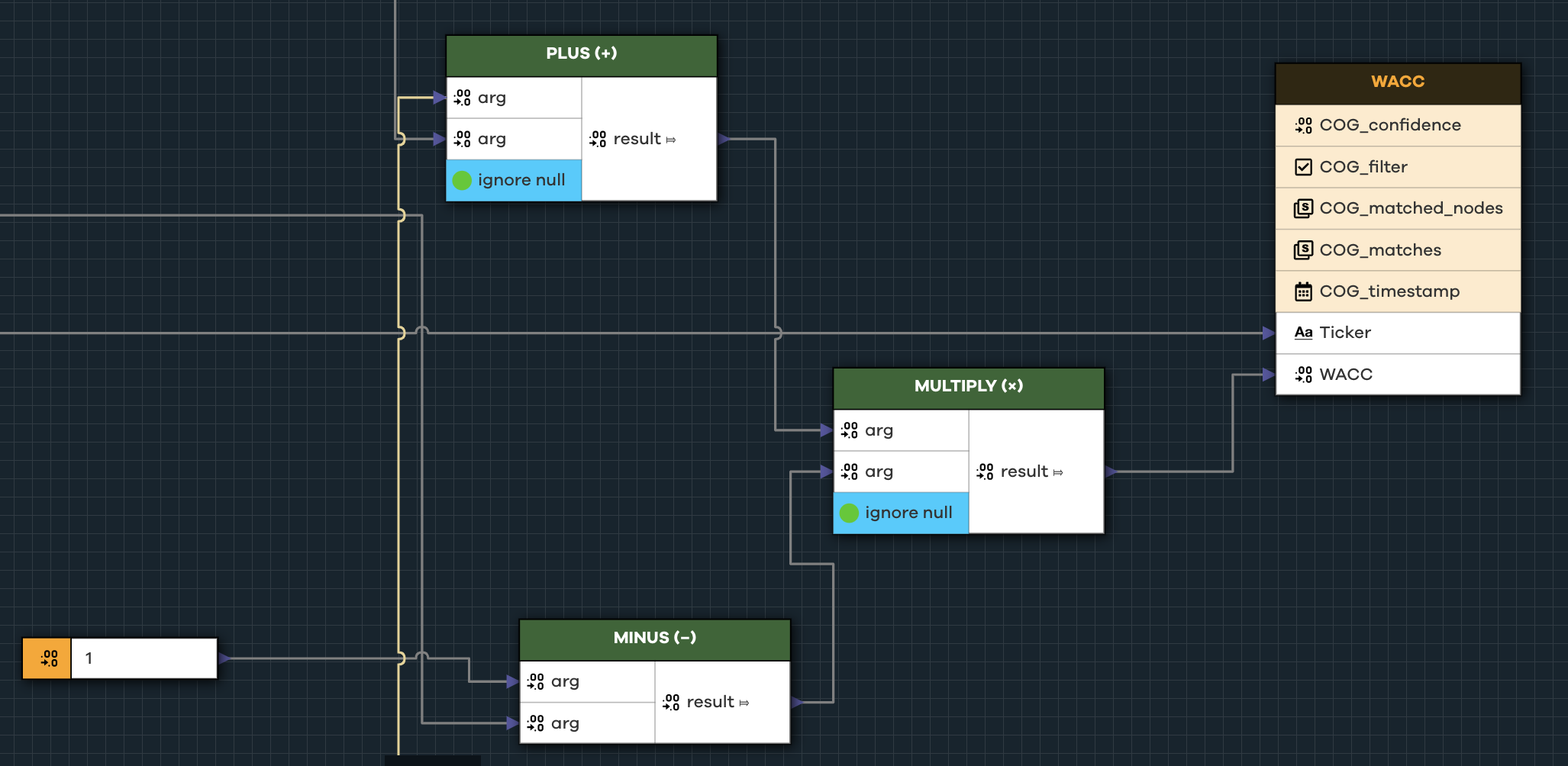

The formula for WACC is translated to Cogynt using computations.

Preparing Data

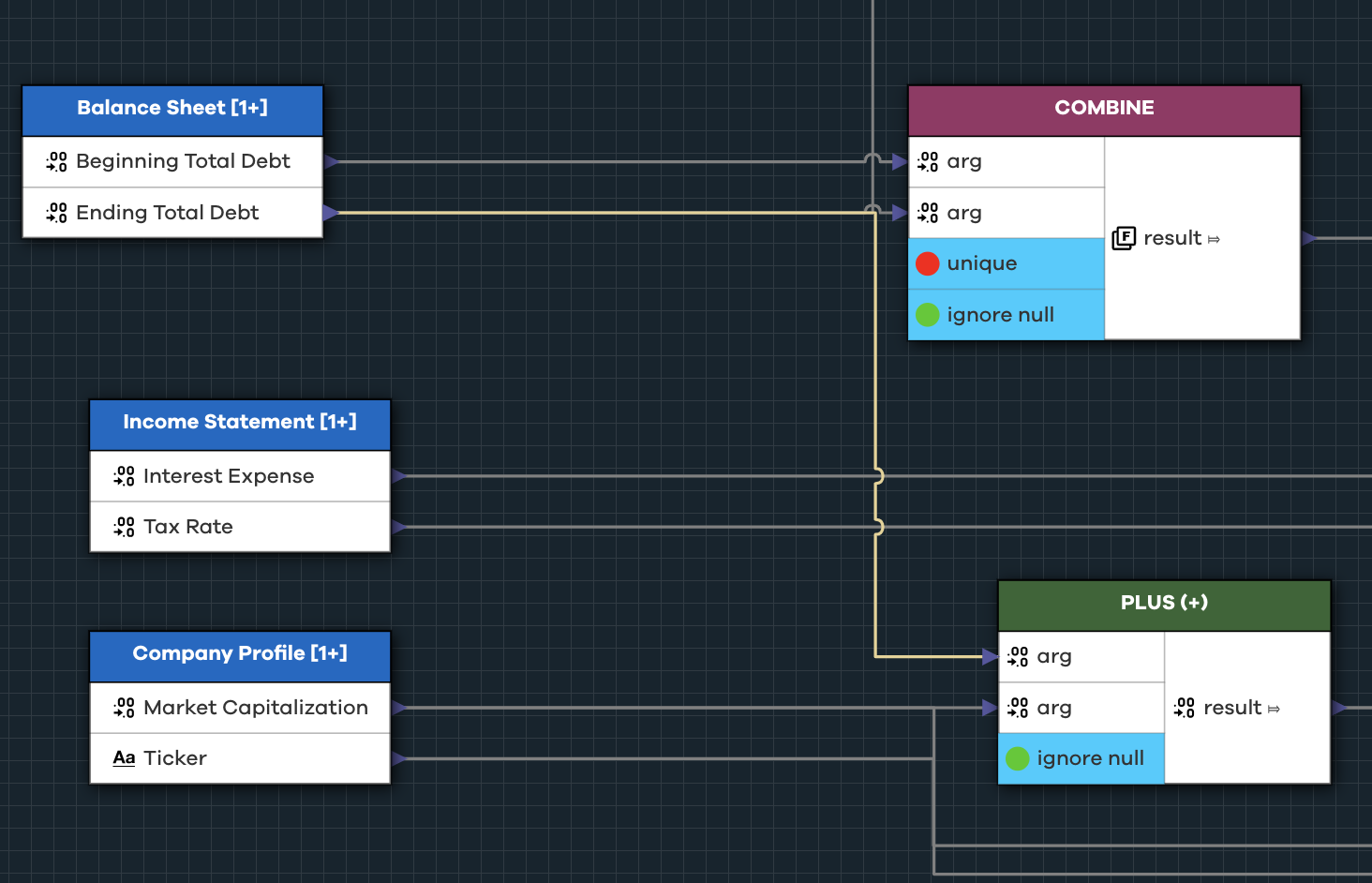

We computed CAPM, or the Capital Asset Pricing Model, in an earlier calculation. The result, called cost of equity, is used in our computations. We also pull in data from income statements, balance sheets, and from the ticker's company profile.

Calculating Market Value of Equity/Capitalization

The market value of equity calculation looks like this:

(E/V * Ke)

This calculation tries to find a company's market capitalization, or the total dollar value of a company's equity. At its heart, this calculation distills the value of a company based on its assets subtracted by its liabilities (debts).

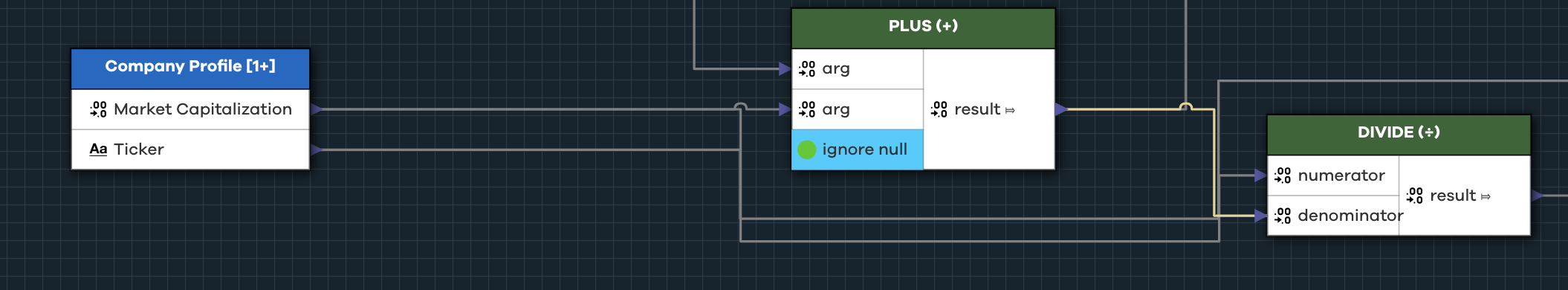

To calculate the market value of equity in Cogynt Authoring:

- Pull the market capitalization value, and use

PLUSto add it to the ending total debt figure. (This isV.)

- Divide market capitalization by that result. (This is

E/V.)

- Multiply the result by the Cost of Equity value. (This is

D/V * Ke, the Cost of Equity that was calculated in the CAPM model.)

The result is the market value of equity.

Market Value of Debt

Cost of debt is the total amount of interest owed on a debt, and is representative of the company's long term debt obligations.

This part of the formula covers:

(D/V)

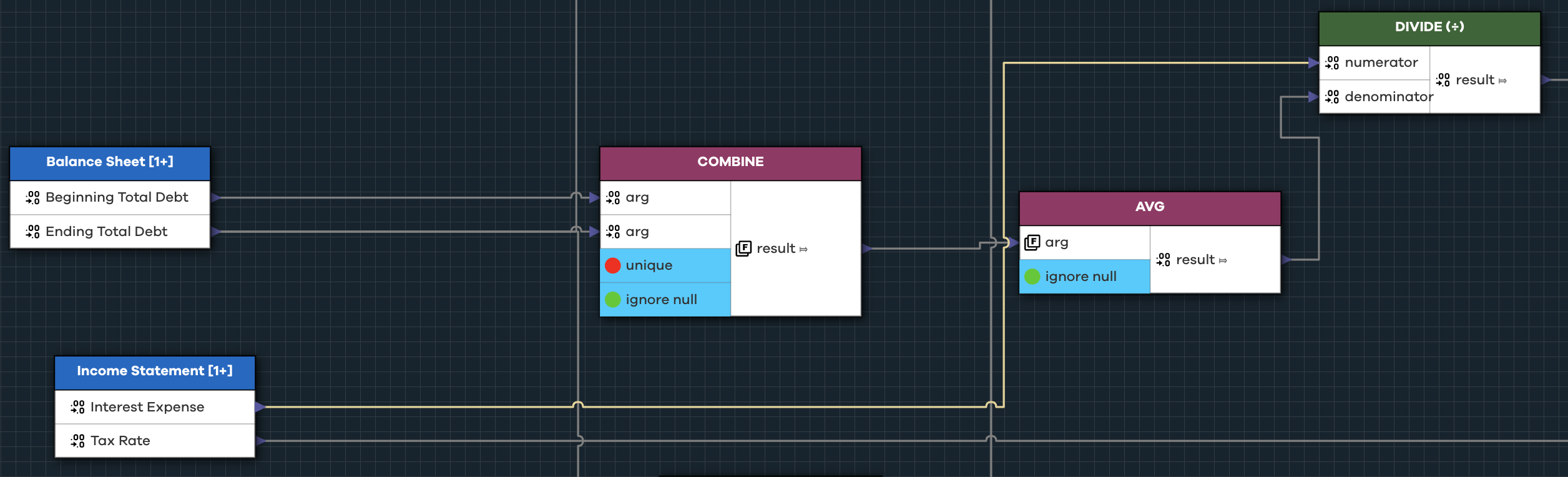

To calculate cost of debt in Cogynt Authoring:

- Use

DIVIDEto divide the ending total debt by the sum of ending and beginning total debt. - Use

COMBINEto combine the beginning and ending values of known total debt. - Use

AVERAGEto get the average value of those two figures. - Use

DIVIDEto divide the average of beginning and ending debt by the interest expense.

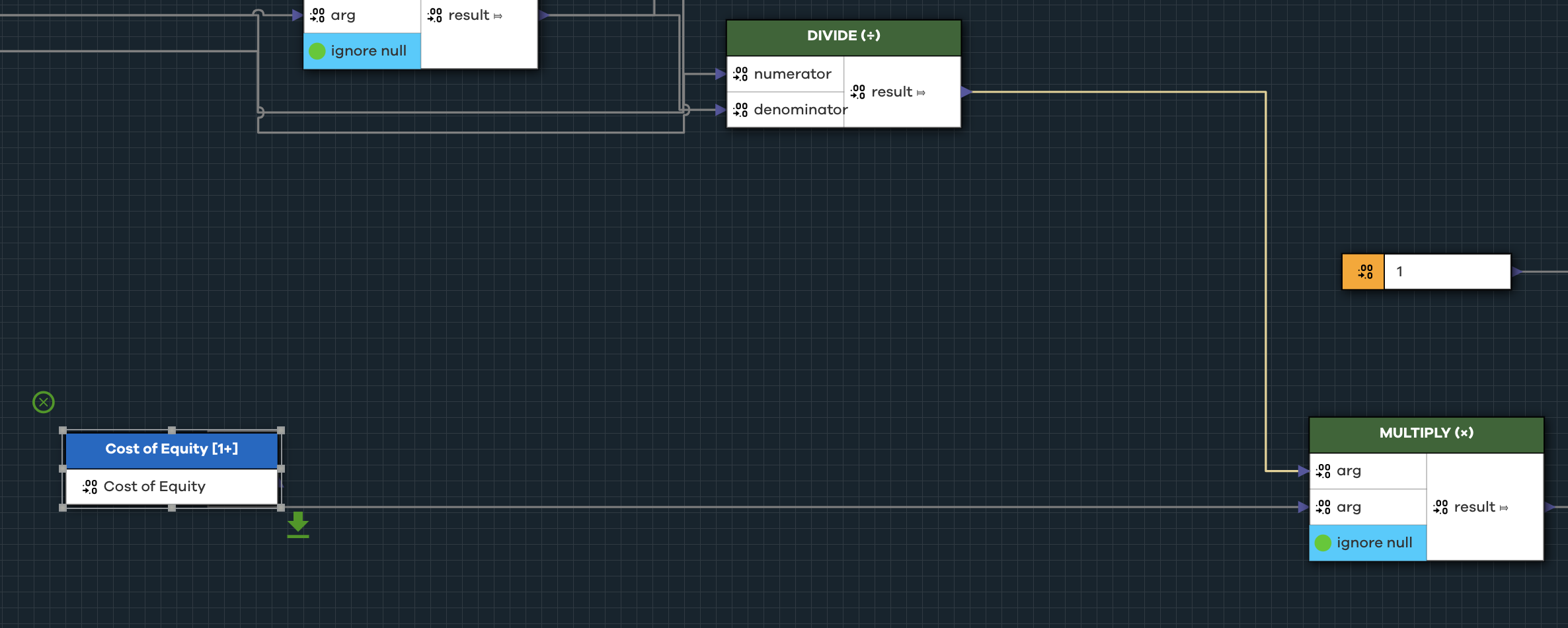

Cost of Equity

The cost of equity represents the return a company must realize before a given or project is worth investment. It's a figure designed to factor in the possible return on an investment the company decides to take on, and it's the final part of the WACC formula.

To calculate cost of equity in Cogynt Authoring:

- Use

MINUSto subtract 1 from the corporate tax rate. - Multiply this value by the Market value of debt.

- Output the result as the WACC value.

Tying WACC Output to DCF

Previously, our DCF model used a flat discount rate of 8%. With WACC properly calculated, we have a much more precise figure for discounting cash flow that will apply to any company we run through our model. Such personalized results are fundamental to stock analysis, but WACC is commonly overlooked. It's a complex formula, and discount rates offer a more convenient solution.

Cogynt's intuitive no-code approach solves this issue. Construct the WACC formula once, run any ticker through it, and the results apply to other parts of the model with minimal analyst input.